Thinking about investing in Larsen & Toubro along with seeing company performance? You’re in the right place! This article talks about some basic ideas for the forecast of Larsen & Toubro Share Price Target for the years 2025, 2030, 2035, and 2040

We’ll look at the company’s Revenue, What projects is the company working on and planning to work on, and how much it’s expected to grow in each year. By seeing all of this, we can estimate the future price. We use expert data and analysis to predict and provide detailed knowledge about Larsen & Toubro. This article can help both new and experienced investors understand Larsen & Toubro share info better and inform investment decisions.

What do Larsen and Toubro do?

Larsen & Toubro is a technology, engineering, construction, and manufacturing company. It is one of the largest and highest-profile companies in India’s private sector. The company businesses are helped by a wide marketing and distribution network, and also it earned a great reputation through strong customer support. The company also operates in the areas of power, infrastructure, electrical, and electronics.

Overview Of Larsen & Toubro Company

| Company Name | Larsen & Toubro L&T India |

| Market Cap | ₹ 505,665 Crore |

| Book Value | ₹ 628 |

| Face Value | ₹ 2 |

Financial Analysis Of Larsen & Toubro

Before you buy a company’s shares, you should look into how well the company is doing. Check things like how much revenue it makes, how much its net sales, and how much its total assets are. We also need to understand some basics of a company like PE ratio, ROA, PB Ratio, and ROE.

The Larsen & Toubro share Price Target also depends on some aspects

1. Larsen & Toubro Revenue of Previous Years

- Revenue Increased by 52.3% from 2020 to 2024

2. Larsen & Toubro Profit and Loss Analysis

| Data | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 | Mar 2024 |

| Net Profit | 9,549 | 11,582 | 8,669 | 10,470 | 13,059 |

| Net Cash Flow | 3,257 | 21,266 | 16,052 | 18,633 | 13,749 |

| Total Assets | 3,06,687 | 3,10,095 | 3,19,027 | 3,29,721 | 3,39,093 |

| Total Liabilities | 2,29,039 | 2,21,051 | 2,23,438 | 2,26,154 | 2,36,543 |

- Net Profit has increased by 36.74% during the period.

- Total Assets have increased by 10.89%.

- Total Liabilities have also increased 3.29%,

- Net Cash Flow has shown a 317.71% increased

3. Larsen & Toubro Ratios

| Metrics | Value |

| PE Ratio | 36.85% |

| ROA (Return On Assets) | 5.30% |

| PB Ratio (Price-To-Book) | 10.84% |

| ROE (Return On Equity) | 26.15% |

PE Ratio (Price To Earning Ratio)

It shows how much money people are willing to pay for each rupee that a company earns.

- Formula – P/E Ratio = (Per share price / Per share earnings)

Return on Assets (ROA)

It means how efficiently a company is using its assets to generate profit.

- Formula – Current Ratio = Current Assets/Current Liabilities

PB Ratio (Price-to-Book Ratio)

It compares a company’s market value (share price) to its book value (net asset value).

- Formula – P/B Ratio = Market per Price Share/Per Book value share

ROE (Return On Equity)

It shows how well a company uses the money its owners put in to make more profit.

- Formula – ROE = Company net income/shareholder’s equity

Larsen & Toubro Share Price History

Larsen & Toubro share were listed for trading on the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) on September 12, 2016, to September 15, 2016. In recent years, the price of Larsen & Toubro share price target has continuously increased. The share price has decreased in the past six months by -21.65 (-0.60%). In the past year, it has risen by +705.80 (24.39%). So far, the total increase is +2,236.55 (164.04%).

Now let’s look into Larsen & Toubro’s future and see where its stock is headed. From 2024 to 2030, we will explore the projected Larsen & Toubro share price target, along with the company’s performance and growth.

Larsen & Toubro Share Price Target 2025

Factors can influence the value of a share price

The budgeted spending for infrastructure increased from 3.7 lakh crore in FY 2022-23 to 5 lakh crore in FY 2023-24, Offering opportunities for private sector investment in various transportation sectors. The Government has also set targets for the transport sector to develop the two lakh-km national highway network and expand airports to 220 by 2025.

| Month | Target |

| January 2025 target | ₹3,767 |

| February 2025 target | ₹3,798 |

| March 2025 target | ₹3,813 |

| April 2025 target | ₹3,855 |

| May 2025 target | ₹3,890 |

| June 2025 target | ₹3,913 |

| July 2025 target | ₹3,978 |

| August 2025 target | ₹3,984 |

| September 2025 target | ₹3,977 |

| October 2025 target | ₹4,034 |

| November 2025 target | ₹4,156 |

| December 2025 target | ₹4,345 |

- The estimated price of one Larsen & Toubro Share Price Target will be around ₹3,767 at the start of 2025.

- If the market does well, the price could go up to ₹3,978 by the middle of the year.

- By the end of 2025, Larsen & Toubro Share Price Target might even reach ₹4,345.

Larsen & Toubro Share Price Target 2030

Factors may impact the value of a share price

India is estimated to spend around Rs 143 lakh crore on infrastructure in the upcoming next 7 years until 2030. which is double the Rs 67 lakh crore spent in the previous 7 years 2017 to 2023, main focus on Urban Transit, Renewable Energy, and ports. The Indian government focuses on the National Coal Gasification Mission to reduce dependency on imports by using coal to produce value-added products.

The government wants to make 20 km of rail lines every day, to add 45,000 Km of rail route in the next 8 years for Rs 12 lakh crore. This will increase the railway’s share by 2030. In addition, there is also the development of Semi-HSR Corridor projects, with Track and Systems packages costing around Rs 25,000 crore book to be completed within the next five years.

| Month | Target |

| January 2030 target | ₹8,214 |

| February 2030 target | ₹8,234 |

| March 2030 target | ₹8,575 |

| April 2030 target | ₹8,798 |

| May 2030 target | ₹8,901 |

| June 2030 target | ₹9,014 |

| July 2030 target | ₹9,225 |

| August 2030 target | ₹9,354 |

| September 2030 target | ₹9,362 |

| October 2030 target | ₹9,375 |

| November 2030 target | ₹9,456 |

| December 2030 target | ₹9,486 |

- The estimated price of Larsen & Toubro Share Price Target will be around ₹8,214 at the start of 2030.

- If the market does well, the price could go up to ₹9,225 by the middle of the year.

- By the end of 2030, Larsen & Toubro Share Price Target might even reach ₹9,486.

Also read- RVNL Share Price Target

Larsen & Toubro Share Price Target 2035

Factors may impact the value of a share price

India’s increasing energy demand and an increase in the Plant Load Factor for improved country energy security. The Ministry of Power estimates that thermal power will continue till 2035. More than 49 GW of coal-based power projects are expected to be provided during the upcoming years.

| Month | Target |

| January 2035 target | ₹11,145 |

| February 2035 target | ₹11,165 |

| March 2035 target | ₹11,378 |

| April 2035 target | ₹11,255 |

| May 2035 target | ₹11,501 |

| June 2035 target | ₹11,715 |

| July 2035 target | ₹11,825 |

| August 2035 target | ₹11,948 |

| September 2035 target | ₹12,056 |

| October 2035 target | ₹12,258 |

| November 2035 target | ₹12,412 |

| December 2035 target | ₹12,524 |

- The estimated price of Larsen & Toubro Share Price Target will be around ₹11,145 at the start of 2035.

- If the market does well, the price could go up to ₹11,825 by the middle of the year.

- By the end of 2035, the share price might even reach ₹12,524.

Larsen & Toubro Share Price Target 2040

Factors may impact the value of a share price

The company has made good growth towards becoming Carbon Neutral by 2040. Reducing energy intensity by 16% and pollution by 12% in the past year. this is achieved by reducing diesel use through digitalization switching from diesel-powered equipment to grid electricity or low-carbon fuel. In addition, the company aims to increase its use of renewable energy on-site ground mounted Solar and Renewable Open access are being used in manufacturing and office spaces.

| Month | Target |

| January 2040 target | ₹20,124 |

| February 2040 target | ₹20,215 |

| March 2040 target | ₹20,246 |

| April 2040 target | ₹20,258 |

| May 2040 target | ₹20,277 |

| June 2040 target | ₹20,281 |

| July 2040 target | ₹20,289 |

| August 2040 target | ₹20,283 |

| September 2040 target | ₹20,296 |

| October 2040 target | ₹21,301 |

| November 2040 target | ₹21,025 |

| December 2040 target | ₹21,265 |

- The estimated price of Larsen & Toubro Share Price Target will be around ₹20,124 at the start of 2040.

- If the market does well, the price could go up to ₹20,289 by the middle of the year.

- By the end of 2040, the share price might even reach ₹21,265.

Larsen & Toubro Share Price Target 2050

Factors may impact the value of a share price

India’s goal is to achieve Net zero by 2050. Our country is focusing on green construction technologies in future infrastructure development. the government is thing about establisng the Mass transit Systems such as Metro/Metro Lite/Metro Neo/Personal Rapid Transit System in Tier 1 and Tier 2 cities as green mobility action to reduce the country’s carbon footprint in the fight against climate change. India’s expertise in chemicals a potential increase in PLI schemes to the chemical and petrochemical sectors showing Well growth prospects. Additionally, investments in coal gasification projects finance and a forecasted doubling of the ammonia market by 2050 indicate good growth in this area.

| Month | Target |

| January 2050 target | ₹31,154 |

| February 2050 target | ₹31,215 |

| March 2050 target | ₹31,246 |

| April 2050 target | ₹31,351 |

| May 2050 target | ₹31,465 |

| June 2050 target | ₹31,699 |

| July 2050 target | ₹31,789 |

| August 2050 target | ₹31,833 |

| September 2050 target | ₹31,995 |

| October 2050 target | ₹32,101 |

| November 2050 target | ₹31,235 |

| December 2050 target | ₹31,265 |

- The estimated price of Larsen & Toubro Share Price Target will be around ₹31,154 at the start of 2050.

- If the market does well, the price could go up to ₹31,789 by the middle of the year.

- By the end of 2050, the share price might even reach ₹31,265.

Shareholding

The company’s growth also depended upon the type of investors who invested in the share.

Promoter shareholding

- Those who invest in the public market expect to profit in the future.

Public shareholding

- Those who invest in the public market expect to profit in the future.

Foreign Institutional Investors or FII

- It refers to investors who are from other countries and who are investing in the Indian financial market.

Domestic Institutional Investors or DII

- Domestic institutional investors (DIIs) are Indian institutions that invest in India’s financial markets.

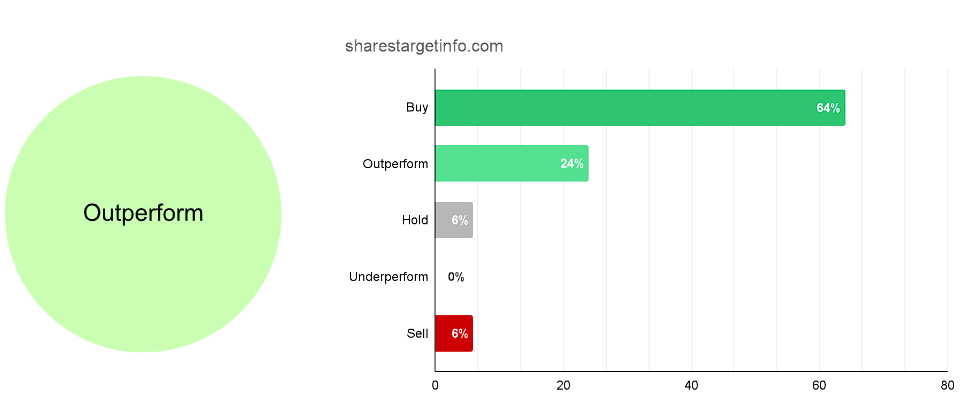

Analyst Rating

Analyst ratings say how an expert sees the stock, how much income the company generates, the project pipeline, share price performance, and other factors. Based on this, they recommend either buy, hold, or sell the stock.

- A majority of analysts 64% recommend buying the share, which indicates that the share is undervalued and will grow in the future

- 26% of analysts recommend holding the stock.

- However, only 6% recommend selling.

- Although only 6% recommend selling.

- The majority of analysts are positive about the share price, with a strong recommendation for buying.

Note: Don’t depend just on expert ratings. Research the stock yourself or seek advice from an expert.

Conclusion

We hope (www.sharestargetinfo.com) gives you basic information about the Larsen & Toubro Share Price Target. By doing research and taking advice from experts, We believe that the Larsen & Toubro Share Price Target will become beneficial in the long run. The Larsen & Toubro Share Price Target might also show an upward trend.

Also read- RailTel Share Price Target

FAQs

Disclaimer

We are not SEBI-registered advisors. We all know investing in the share market is risky. This website is for training and educational purposes only. Please Consult or take advice from certified experts before investing. We will not be responsible for any loss.

[…] Also Read– Larsen & Toubro Share Price Target […]

[…] Also Read- Larsen & Toubro Share Price Target […]