If you’re thinking about investing in Mazagon Dock Ship Builders and company performance, you should look at Mazagon Dock Shipbuilders. This article talks about some basic ideas for the forecast of Mazagon Dock Share Price Target for 2024, 2025, 2027, 2030

We’ll look at the company’s Revenue, What projects is the company working on and planning to work on, and how much it’s expected to grow in each year. By seeing all of this, we can estimate what the future price will be. We use expert data and analysis to predict and provide detailed knowledge about Mazagon Dock Shipbuilders. This article can help both new and experienced investors understand Mazagon Dock Ship Builders share info better and inform investment decisions.

What do the Mazagon Dock Shipbuilders do?

Mazagon Dock Shipbuilders Limited is a shipyard in Mumbai, India. They make ships for the Indian Navy, like warships and submarines. They also build other ships for offshore oil drilling and transportation.

Overview Of Mazagon Dock Shipbuilders Company

The Mazagon Dock Limited (MDL) was started as a small company that repaired ships. It was later registered as a public company in 1934. In 1960 holding an 84.83% stake, the government took control of the shipyard. It builds warships for the Indian Navy and other ships for the country. Since 1960, Mazagon Dock Shipbuilders has built total 802 vessels including 28 warships, from advanced destroyers to missile boats and 7 submarines.

| Company Name | Mazagon Dock Shipbuilders |

| Market Cap | ₹ 99, 176 Crore |

| Book Value | ₹ 309.56 |

| Face Value | ₹ 10 |

Financial Analysis Of Mazagon Dock Shipbuilders

Before you buy a company’s shares, you should look into how well the company is doing. Check things like how much revenue it makes, how much its net sales, and how much its total assets are. We also need to understand some basics of a company like PE ratio, ROA, PB Ratio, and ROE. The Mazagon Dock Share Price Target also depends on the ratio

1. Mazagon Dock Previous Year Revenue

2. Mazagon Dock Profit and Loss Analysis

| Data (in Cr) | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 | Mar 2024 |

| Net Profit | 470 | 513 | 610 | 1,119 | 1,936 |

| Net Cash Flow | -205 | 26 | -197 | 1,374 | 252 |

| Total Assets | 20,942 | 25,140 | 29,772 | 29,475 | 29,463 |

| Total Liabilities | 17,883 | 21,708 | 25,915 | 24,715 | 23,219 |

- Net Profit Increased by 309.36%

- Net Cash Flow Increased by 124.39%%

- Total Assets Increased by 40.74%%

- Total Liabilities decreased by 6.07%%

3. Mazagon Dock Ratios

| Metrics | Value |

| PE Ratio | 51.20% |

| ROA (Return On Assets) | 9.04% |

| PB Ratio (Price-To-Book) | 15.88% |

| ROE (Return On Equity) | 31.02% |

PE Ratio (Price To Earning Ratio)

PE Ratio is calculated by the ratio of the share price of a stock to its earnings per share (EPS)

Return on Assets (ROA)

ROE means a company’s Profit and efficiency by dividing its net income by shareholder equity

PB Ratio

PB ratio means comparing a company’s market value to its book value( the value of all assets minus liabilities)

ROE (Return On Equity)

ROE means how well a company utilizes shareholder’s money. It’s calculated by net income divided by equity financing.

Mazagon Dock Share Price History

Mazagon Dock Shipbuilders share was first available for trading on the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) on September 29, 2020. In recent years, the price of Mazagon Dock Share Price Target has been continuously increasing. In the past six months, the share price has increased by +2,733.00 rupees (125.25%). In the past year, it has increased by +3,120.80 rupees (173.94%). So far, the total increase is +4,746.95 rupees (2,824.72%).

If you are looking for a long-term investment, Mazagon Dock Ship Builders shares could be a good option. Now let’s take a look at the projected share price targets for Mazagon Dock Ship Builders from 2024 to 2030, along with the company’s performance and growth.

Mazagon Dock Share Price Target 2024

Factors can influence the value of a share price

In last year Mazagon Dock Shipbuilders revenue was the highest ever at ₹7,827 crore, which shows they are doing great financially. They also made a profit of ₹1,073 crore, which is 83% higher than the previous year. For the last 15 years, Mazagon Dock has been making profits and giving dividends to investors. This makes it a good choice for people who want good returns for the long term. They gave a final dividend of ₹138.36. This is good news for investors.

In the below table, you find the estimated Mazagon Dock Share Price Target for the year 2024:

| Months | Targets |

| August 2024 targets | ₹4,915.00 |

| September 2024 targets | ₹6,233.66 |

| October 2024 targets | ₹6,362.12 |

| November 2024 targets | ₹6,516.19 |

| December 2024 targets | ₹7,235.45 |

Summary

- At its highest, the Mazagon Dock Share Price Target might reach ₹7,635.45 by the end of the year

Mazagon Dock Share Price Target 2025

Factors can influence the value of a share price

Mazagon Dock Limited is a vital player in India’s defense industry. In India, it is the only shipyard that built destroyers and conventional submarines for the Indian Navy. this shows a strong position that the government consistently gives Mazagon Dock Limited contracts and long-term projects. They collaborate with top Indian universities like IITs, the Welding Research Institute in Trichy, and IISc Bangalore. They’re working together to come up with new ideas and improve technology. The new launch of advanced vessels like the Fuel Cell Electric Vessel (FCEV) shows innovation and being a leader in the industry also they spent 96.52 crores rupees on research and development this year. This indicates that they are trying to improve their technology.

In the below table, you find the estimated Mazagon Dock Share Price Target for the year 2025:

| Months | Targets |

| January 2025 targets | ₹7,412.63 |

| February 2025 targets | ₹7,422.54 |

| March 2025 targets | ₹7,455.13 |

| April 2025 targets | ₹7,592.56 |

| May 2025 targets | ₹7,897.86 |

| June 2025 targets | ₹8,053.39 |

| July 2025 targets | ₹8,363.60 |

| August 2025 targets | ₹8,593.75 |

| September 2025 targets | ₹8,693.43 |

| October 2025 targets | ₹8,750.65 |

| November 2025 targets | ₹8,905.18 |

| December 2025 targets | ₹9,562.95 |

Summary

- The estimated price of one Mazagon Dock Share Price Target will be around ₹7,412.63 at the start of 2025.

- If the market does well, the price could go up to ₹8,053 by the middle of the year.

- By the end of 2025, the Mazagon Dock Share Price Target might even reach ₹9,562.95.

Mazagon Dock Share Price Target 2027

Factors can influence the value of a share price

The company has made efforts in sustainability, They’ve used less energy and made less waste. They’re also good at recycling. The company is spending income to improve its factories and use better technology. This will help them make things faster and cheaper in the long run. The company has built special places like Shore Integration Facilities (SIF) and a Virtual Reality Lab to test and build ship parts before they are put on the actual ship.

By testing everything carefully on land first, they can make sure that the ship parts work safely and reliably when they are finally used on the ship. They have used (AI) to make their work better. They’ve used (radiography) and (ultrasonic testing) to check welds for problems. This helps them make sure welds are strong and safe. They’ve also used AI to help them make things in their factory better and cheaper.

In the below table, you find the estimated Mazagon Dock Share Price Target for the year 2025:

| Months | Targets |

| January 2027 targets | ₹10,943.41 |

| February 2027 targets | ₹11,143.63 |

| March 2027 targets | ₹11,180.11 |

| April 2027 targets | ₹11,346.03 |

| May 2027 targets | ₹11,869.11 |

| June 2027 targets | ₹12,078.51 |

| July 2027 targets | ₹12,158.51 |

| August 2027 targets | ₹12,369.86 |

| September 2027 targets | ₹12,569.86 |

| October 2027 targets | ₹12,618.90 |

| November 2027 targets | ₹12,790.93 |

| December 2027 targets | ₹12,853.52 |

Summary

- The estimated price of one Mazagon Dock Share Price Target will be around ₹10,943.41 at the start of 2020.

- If the market does well, the price could go up to ₹12,078.51 by the middle of the year.

- By the end of 2027, the Mazagon Dock Share Price Target might even reach ₹12,853.52.

Mazagon Dock Share Price Target 2030

Factors can influence the value of a share price

There is a Global Demand for Naval Defense Equipment many countries want to modernize their navy ships which means they have a chance for companies like Mazagon Dock to sell them new ships. Mazagon Dock can focus on selling ships to other countries like Southeast Asia, Africa, and South America are interested in stronger navies. India can help these countries by selling them ships through the government. Mazagon Dock can also build other types of ships for other countries. These could be carrying gas, huge ships for carrying containers, or special ships for working in the ocean. This will help the company make more revenue or profit.

In the below table, you find the estimated Mazagon Dock Share Price Target for the year 2030:

| Months | Targets |

| January 2030 targets | ₹18,019.56 |

| February 2030 targets | ₹18,219.43 |

| March 2030 targets | ₹18,519.12 |

| April 2030 targets | ₹18,619.16 |

| May 2030 targets | ₹19,290.14 |

| June 2030 targets | ₹19,495.94 |

| July 2030 targets | ₹19,655.64 |

| August 2030 targets | ₹19,785.16 |

| September 2030 targets | ₹19,997.10 |

| October 2030 targets | ₹20,258.38 |

| November 2030 targets | ₹20,358.38 |

| December 2030 targets | ₹20,558.38 |

Summary

- The estimated price of one Mazagon Dock Share Price Target will be around ₹18,019.56 at the start of 2030.

- If the market does well, the price could go up to ₹19,495.94 by the middle of the year.

- By the end of 2030, the Mazagon Dock Share Price Target might even reach ₹20,558.38

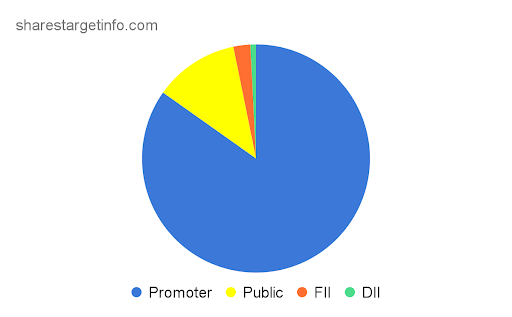

Shareholding

The company’s growth also depended upon the type of investors who invested in the share.

Promoter shareholding means shares owned by company owners through overall capital. Mazagon Dock ShipBuildersCompany’s promoter holding capacity is 84.8%.

Public shareholding is those who invest in the public market to expect to gain profit in the future. Mazagon Dock ShipBuildersCompany’s public Holding capacity is 11.9%.

Foreign Institutional Investors or FII refers to investors who are from other countries and who are investing in the Indian financial market. Mazagon Dock ShipBuildersCompany’s FII is 2.4%.

Domestic Institutional Investors or DII Domestic Institutional Investors (DIIs) are Indian institutions that invest in the financial markets of India. Mazagon Dock ShipBuildersCompany’s DII is 0.8%.

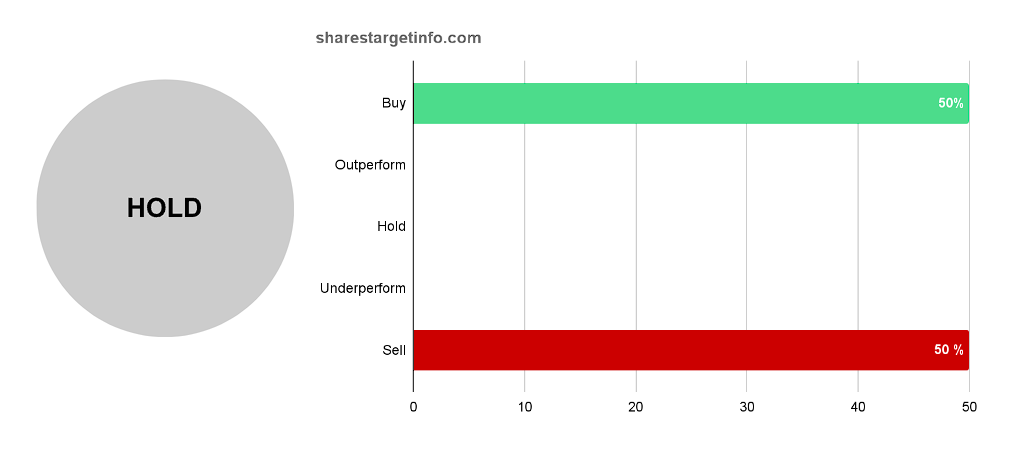

Analyst Rating

Analyst ratings say how an expert sees the stock, how much income the company generates, the project pipeline, share price performance, and other factors. Based on this, they recommend either buy, hold, or sell the stock.

Summary

In general, analysts are bullish about the stock.

- A majority of analysts (50%) recommend buying the share, indicating that it is undervalued and has good growth potential.

- Although (50%) recommend selling, the overall opinion is to Hold the stock

Note- Don’t depend entirely on analyst ratings. Research the stock yourself or ask for help from an expert. Analyst ratings are simply one part of the puzzle.

FAQ

Conclusion

We hope (www.sharestargetinfo.com) gives you basic information about the Mazagon Dock Share Price Target. By doing research and taking advice from experts, the long-term basis of the Mazagon Dock Share Price Target will go to a high position. Mazagon Dock Shipbuilders is related to the manufacture of warships and submarines. The share price might also go up in the future and also help the share to gain profit.

If you find this website helpful for you, you can feel free to share it. If you have any questions please let us know in the comment box below, we’ll try to answer questions and help you. Thanks for visiting our website and thank you for staying with us.

Also Read– Cochin Shipyard Share Price Target

Disclaimer

We are not SEBI-registered advisors. We all know investing in the share market is risky. This website is for only for training and educational purposes only. Please Consult or take advice from certified experts before investing. We will not be responsible for any loss.