Thinking about investing in HAL along with seeing company performance? You’re in the right place! This article talks about some basic ideas for the forecast of HAL Share Price Target for the years 2025, 2030, 2035, and 2040 We’ll look at the company’s Revenue, What projects is the company working on and planning to work on, and how much it’s expected to grow in each year. By seeing all of this, we can estimate the future price. We use expert data and analysis to predict and provide detailed knowledge about HAL. This article can help both new and experienced investors understand HAL share info better and inform investment decisions.

What does the Hindustan Aeronautics Limited (HAL) do?

Hindustan Aeronautics Limited (HAL) is an aerospace and defense company, headquartered located in Bangalore. It makes aerospace and defense products. HAL builds fighter jets, helicopters, jet engines, marine gas turbine engines, software development, etc. They also fix and upgrade Indian military aircraft.

Overview Of Hindustan Aeronautics Limited (HAL) Company

HAL is an Indian company that makes airplanes and other products for the army. It is one of the oldest and biggest companies in the whole world. Hal has 11 Research and development centers and 21 manufacturing units under 4 production units spread across India.

| Company Name | Hindustan Aeronautics Limited (HAL) |

| Market Cap | ₹ 2,93,958.96 Crore |

| Book Value | ₹ 435.96 |

| Face Value | ₹ 5 |

Financial Analysis Of Hindustan Aeronautics Limited (HAL)

Before you buy a company’s shares, you should look into how well the company is doing. Check things like how much revenue it makes, how much its net sales, and how much its total assets are. We also need to understand some basics of a company like PE ratio, ROA, PB Ratio, and ROE. The HAL’s share Price Target also depends on the ratio

1. HAL Revenue

- Revenue Increased by 41.73% from 2020 to 2024

2. HAL Profit and Loss Analysis

| Data | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 | Mar 2024 |

| Net Profit | 2,865 | 3,245 | 5,080 | 5827 | 7,621 |

| Net Cash Flow | +252 | +6,866 | -4,075 | +1,370 | -186 |

| Total Assets | 54,202 | 53,096 | 60,254 | 69,276 | 80,910 |

| Total Liabilities | 40,949 | 37,668 | 40,937 | 45,700 | 51,769 |

- Net Profit has increased by 163.78% during the period.

- Total Assets have increased by 49.22%.

- Total Liabilities have also increased 26.44%, but at a slower compared to total assets.

- Net Cash Flow has shown very ups and downs and does not show a consistent trend.

3. HAL Share Price Target Ratios

| Metrics | Value |

| PE Ratio | 41.45% |

| ROA (Return On Assets) | 9.73% |

| PB Ratio (Price-To-Book) | 10.84% |

| ROE (Return On Equity) | 26.15% |

PE Ratio (Price To Earning Ratio)

It shows how much money people are willing to pay for each rupee that a company earns.

- Formula – P/E Ratio = (Per share price / Per share earnings)

Return on Assets (ROA)

It means how efficiently a company is using its assets to generate profit.

- Formula – Current Ratio = Current Assets/Current Liabilities

PB Ratio (Price-to-Book Ratio)

It compares a company’s market value (share price) to its book value (net asset value).

- Formula – P/B Ratio = Market per Price Share/Per Book value share

ROE (Return On Equity)

It shows how well a company uses the money its owners put in to make more profit.

- Formula – ROE = Company net income/shareholder’s equity

Historical Data of HAL Shares

HAL share were listed for trading on the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) on March 28, 2018. In recent years, the HAL Share Price Target has continuously increased. The share price has increased in the past six months by +1,898.75 (66.72%). In the past year, it has risen by +2,807.42 (144.75%). So far, the total increase is +4,180.43 (738.04%).

Now let’s take a look at the projected HAL Share Price Target from 2024 to 2030, along with the company’s performance and growth.

HAL Share Price Target 2025

Factors may impact the value of a share price

HAL has strong financial performance, they made more revenue than the previous year by around ₹28,16,185 Lakh, a 7% increase from the previous year, while Profit after tax increased by 31% to ₹7,59,504 Lakh. Hal has a lot of orders lined up in the future. They had lots of orders worth of ₹94,12,900 lakhs as of March 31, 2024. HAL plans to invest Rs 140-150 billion in the next 5 years to build more factories to make engines like Tejas Mk2, GE-414, and IMRH, develop new planes (AMCA, IMRH), and fix old factories. HAL will spend Rs 6 billion to make its parts instead of buying them from other countries.

In the table below, you will find the estimated forecast of the HAL Share Price Target for the year 2025:

| Months | Targets |

| January 2025 targets | ₹5,790.80 |

| February 2025 targets | ₹5,810.75 |

| March 2025 targets | ₹5,823.15 |

| April 2025 targets | ₹5,846.18 |

| May 2025 targets | ₹5,875.62 |

| June 2025 targets | ₹5,880.56 |

| July 2025 targets | ₹5,889.23 |

| August 2025 targets | ₹5,954.15 |

| September 2025 targets | ₹5,964.23 |

| October 2025 targets | ₹6,106.04 |

| November 2025 targets | ₹6,224.09 |

| December 2025 targets | ₹6,670.97 |

Summary

- The estimated price of one HAL Share Price Target will be around ₹5,790.80 at the start of 2025.

- If the market does well, the price could go up to ₹5,889.23 by the middle of the year.

- At its highest, the share price might reach ₹6,670.97 by the end of the year

HAL Share Price Target 2030

Factors may impact the value of a share price

HAL profit is expected to increase by 10% to 9.2% in the next FY 25 and FY26. The sales have grown by 18.2% in the last quarter, they also made an EBITA margin of 40% which is better than the 26% they made last year, The company expected to get new orders worth around Rs 470 billion in FY25 for 12 LUH, 12 Su-30 aircraft, and 240 AL 31-FP engines.

Not only this it also has a big order pipeline worth Rs 1.6 trillion and Rs 1.7 trillion for the next 3 years including 97 Tejas Mk1A, 60 Naval UHM, 156 LCH Prachand, 43 ALH Dhruv, and Dornier aircraft upgrade. These orders Provide HAL Revenue visibility until at least FY32, It shows HAL Share Price Target manufacturing is expected to grow fast in the upcoming 7 to 8 years and generate more profit.

In the table below, you will find the estimated forecast of the HAL Share Price Target for the year 2030:

| Months | Targets |

| January 2030 targets | ₹11,790.80 |

| February 2030 targets | ₹11,810.75 |

| March 2030 targets | ₹11,823.15 |

| April 2030 targets | ₹11,846.18 |

| May 2025 targets | ₹11,875.62 |

| June 2030 targets | ₹11,880.56 |

| July 2030 targets | ₹11,889.23 |

| August 2030 targets | ₹11,954.15 |

| September 2030 targets | ₹11,964.23 |

| October 2030 targets | ₹12,106.04 |

| November 2030 targets | ₹12,224.09 |

| December 2030 targets | ₹12,670.97 |

Summary

- The estimated price of one HAL Share Price Target will be around ₹5,790.80 at the start of 2030.

- If the market does well, the price could go up to ₹5,880.56 by the middle of the year.

- By the end of 2030, the share price might even reach ₹6,670.97.

HAL Share Price Target 2035

Factors may impact the value of a share price

HAL is collaborating with Big companies to get better at making aircraft parts. They joined Safran from France to make helicopter engines together, and they also joined to work with General Electric for manufacturing GE-414 aero-engines in India. HAL is enhancing its technological ability. This helps them to grow and stay ahead of the competition in the market. HAL is invested in research and development (R&D), around ₹2,82,624 Lakh, which is 10.04% of its turnover. HAL makes sure they are always using the latest and best technology. This helps them to be the best in the aerospace and defense industry and stay ahead of other companies.

In the table below, you will find the estimated forecast of the HAL Share Price Target for the year 2035:

| Months | Targets |

| January 2035 targets | ₹18,870.97 |

| February 2035 targets | ₹18,920.32 |

| March 2035 targets | ₹18,964.12 |

| April 2035 targets | ₹18,980.85 |

| May 2035 targets | ₹18,995.61 |

| June 2035 targets | ₹19,050.74 |

| July 2035 targets | ₹19,450.74 |

| August 2035 targets | ₹19,804.81 |

| September 2035 targets | ₹19,950.04 |

| October 2035 targets | ₹19,980.07 |

| November 2035 targets | ₹20,001.94 |

| December 2035 targets | ₹20,201.94 |

Summary

- The estimated price of one HAL Share Price Target will be around ₹6,870.97 at the start of 2035.

- If the market does well, the price could go up to ₹7,050.74 by the middle of the year.

- By the end of 2035, the share price might even reach ₹8,201.94.

HAL Share Price Target 2040

Factors may impact the value of a share price

In recent times, under the self-reliance drive, India’s annual Defence production is expected to reach ₹3 lakh crores, by 2028-2029, along with weapons exports worth ₹50,000 crores, India with the name of arms exporter to other countries now it is one of the top 25 arms exporters in the world with around 21,000 Crore export value in the year 2023-24

On the other hand, civil aviation is becoming one of the fastest-growing sectors in India it’s expected that over 500 million people will travel by air within India and to other countries, which indicates it might become the world’s leading aviation market by 2047 Based on traffic forecast, Air India ordered 470 new planes, and IndiGo ordered 500 new planes. So after all this shows the HAL Share Price Target expected growth of the defense sector in the coming years.

In the table below, you will find the estimated forecast of the HAL Share Price Target for the year 2040:

| Months | Targets |

| January 2040 targets | ₹29,111.94 |

| February 2040 targets | ₹29,242.75 |

| March 2040 targets | ₹29,563.55 |

| April 2040 targets | ₹29,644.35 |

| May 2040 targets | ₹29,749.15 |

| June 2040 targets | ₹29,845.55 |

| July 2040 targets | ₹29,952.95 |

| August 2040 targets | ₹30,155.77 |

| September 2040 targets | ₹30,379.20 |

| October 2040 targets | ₹30,485.08 |

| November 2040 targets | ₹30,759.47 |

| December 2040 targets | ₹30,849.57 |

Summary

- The estimated price of one HAL Share Price Target will be around ₹11,111.94 at the start of 2040.

- If the market does well, the price could go up to ₹11,845.55 by the middle of the year.

- By the end of 2040, the share price might even reach ₹12,849.57.

Shareholding

The company’s growth also depended upon the type of investors who invested in the share.

Promoter shareholding

- Those who invest in the public market expect to profit in the future.

Public shareholding

- Those who invest in the public market expect to profit in the future.

Foreign Institutional Investors or FII

- It refers to investors who are from other countries and who are investing in the Indian financial market.

Domestic Institutional Investors or DII

- Domestic institutional investors (DIIs) are Indian institutions that invest in India’s financial markets.

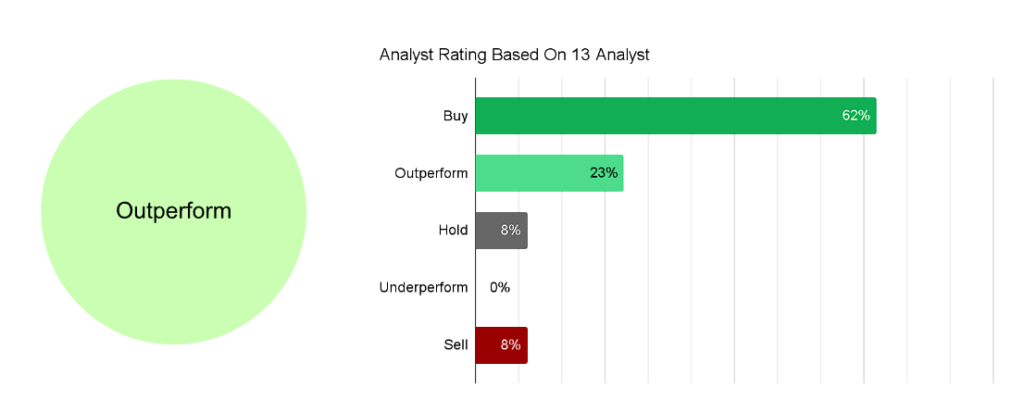

Analyst Rating

Analyst ratings say how an expert sees the stock, how much income the company generates, the project pipeline, share price performance, and other factors. Based on this, they recommend either buy, hold, or sell the stock.

Summary

In general, analysts are bullish about the stock.

- A majority of analysts (62%) recommend buying the share, indicating that it is undervalued and has good growth potential.

- (23%) predict the stock will outperform in the market.

- Although only 8% recommend holding or selling, overall opinion is positive.

Note- Don’t depend entirely on analyst ratings. Research the stock yourself or ask for help from an expert. Analyst ratings are simply one part of the puzzle.

Also read- Bharat Electronics Share Price Target

Conclusion

We hope (www.sharestargetinfo.com) gives you basic information about the HAL Share Price Target. HAL Share Price Target looks good for the long-term play on growing as India’s air defense with a primary supplier of India’s military aircraft, Orders worth over Rs 2 trillion for the next upcoming years, and it’s also learning to make better planes and engines. It shows that HAL Share Price Target will continue to earn revenue in the long run.

If you find this website helpful for you, you can feel free to share it. If you have any questions please let us know in the comment box below, we’ll try to answer questions and help you. Thanks for visiting our website and thank you for staying with us.

FAQs About Hindustan Aeronautics Limited (HAL)

Disclaimer

We are not SEBI-registered advisors. We all know investing in the share market is risky. This website is for only for training and educational purposes only. Please Consult or take advice from certified experts before investing. We will not be responsible for any loss.