Are you thinking about investing in IRB Infra and seeing the company’s performance? You’re in the right place! This article talks about some basic ideas for the forecast of IRB Infra Share Price Target for the years 2025, 2035, 2030, 2040, and 2050

We’ll look at the company’s Revenue, What projects it is working on and planning to work on, and how much it’s expected to grow each year. By seeing all of this, we can estimate the future price. We use expert data and analysis to predict and provide detailed knowledge about IRB Infra. This article can help new and experienced investors understand IRB Infra share info better and inform investment decisions.

Overview Of IRB Infra Company

IRB Infrastructure Developers Ltd. was founded to fulfill the financing needs of the IRB Group’s infrastructure operations. The Company makes many road infrastructure projects using several Special Purpose Vehicles (SPV). The company, along with its subsidiaries has built, worked, and maintained almost 8,000 lane km of road length until now and it is one of the major road developers in the country.

| Company Name | Irb Infra dev ltd |

| Market Cap | ₹ 37,103 Crore |

| Book Value | ₹ 22.76 |

| Face Value | ₹ 1 |

IRB Infra Share Price History

In recent years, IRB Infra share price target have continuously increased. The share price has increased in the past six months by +10.45 (20.51%). In the past year, it has risen by +29.25 (90.98%). So far, the total increase is +42.04 (217.15%).

Now, look into IRB Infra’s future and see where its stock is headed. From 2025, 2030, 2035, 2040, and 2050, we will explore the projected IRB Infra Share Price Target, along with some factors.

Factors That Influence IRB Infra Share Price Target

Company Performance

1. Revenue Growth of Previous Years

- Revenue Increased by 8.12% from 2020 to 2024

2. IRB Infra Cash Flow, Asset, and Liability Analysis

| Data | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 | Mar 2024 |

| Net Cash Flow | +165 | +210 | -600 | +253 | 67 |

| Total Assets | 39,885 | 41,171 | 42,481 | 42,702 | 44,869 |

| Total Liabilities | 33,202 | 34,270 | 29,915 | 29,323 | 31,125 |

- Net Cash Flow shows a fluctuation over the period and does not show a consistent trend

- Total Assets have increased by 12.50% from March 2020 to March 2024.

- Total Liabilities have increased by 5.80% from March 2020 to March 2024.

3. Net Profit Margin

- Net Profit Margin has increased by 15.53% from 2020 to 2024

4. Debt to Equity

- The debt-equity has increased by 6.25% from 2020 to 2024

Economic Growth

Economic growth plays an important role in any share price. As India’s economy increases, the demand for road infrastructure will increase. IRB Infra gets an advantage from government spending on highways and urban projects. the company earns revenue from tolls collected on roads it manages. Inflation can also help to raise the toll rates, which generates profit. So, the economy is strong IRB Infra Share Price Target might increase.

Technological Advancements and Innovation

IRB Infra is doing well in technology improvement through, Automation, Green and Sustainable Technologies, and Digital and Smart Infrastructure. By implementing these advanced technologies the company smoothly runs its operations and increases its financial position, also focuses on green practices and digital infrastructure because it cares about the environment. This may attract investors and increase its share price.

Government Policies

The Indian government is building infrastructure including road and highway projects under initiatives like Bharatmala Pariyojana, National Infrastructure Pipeline (NIP), and Gati Shakti. If the infrastructure is supported by the government, then the company’s share price might go up in the future. but on the other hand, if the government changes its public-private partnership policies or delays in projects can negatively impact the IRB Infra Share Price Target.

Foreign Investors

Foreign investors like Cintra (Spain) & GIC (Singapore) have invested in IRB Infra. which increases trust in the company. This allows the company to take big projects, refinance debts, and make the company financially stronger, Global investors also bring expertise, which adds to the company’s success, having a foreign investor might boost the IRB Infra Share Price Target.

IRB Infra Share Price Target 2025

| Month | Target |

| January 2025 target | ₹88 |

| February 2025 target | ₹95 |

| March 2025 target | ₹98 |

| April 2025 target | ₹102 |

| May 2025 target | ₹105 |

| June 2025 target | ₹107 |

| July 2025 target | ₹109 |

| August 2025 target | ₹110 |

| September 2025 target | ₹113 |

| October 2025 target | ₹117 |

| November 2025 target | ₹118 |

| December 2025 target | ₹117 |

- The estimated price of one IRB Infra Share Price Target will be around ₹88 at the start of 2025.

- If the market does well, the price could go up to ₹109 by the middle of the year.

- By the end of 2025, the share price might even reach ₹117.

IRB Infra Share Price Target 2030

| Month | Target |

| January 2030 target | ₹250 |

| February 2030 target | ₹252 |

| March 2030 target | ₹257 |

| April 2030 target | ₹262 |

| May 2030 target | ₹265 |

| June 2030 target | ₹267 |

| July 2030 target | ₹268 |

| August 2030 target | ₹270 |

| September 2030 target | ₹273 |

| October 2030 target | ₹277 |

| November 2030 target | ₹278 |

| December 2030 target | ₹282 |

- The estimated price of one IRB Infra Share Price Target will be around ₹250 at the start of 2030.

- If the market does well, the price could go up to ₹268 by the middle of the year.

- By the end of 2030, the share price might even reach ₹282.

IRB Infra Share Price Target 2035

| Month | Target |

| January 2035 target | ₹282 |

| February 2035 target | ₹282 |

| March 2035 target | ₹282 |

| April 2035 target | ₹282 |

| May 2035 target | ₹282 |

| June 2035 target | ₹282 |

| July 2035 target | ₹282 |

| August 2035 target | ₹282 |

| September 2035 target | ₹282 |

| October 2035 target | ₹282 |

| November 2035 target | ₹282 |

| December 2035 target | ₹282 |

- The estimated price of one IRB Infra Share Price Target will be around ₹250 at the start of 2035.

- If the market does well, the price could go up to ₹268 by the middle of the year.

- By the end of 2035, the share price might even reach ₹282.

IRB Infra Share Price Target 2040

| Month | Target |

| January 2040 target | ₹750 |

| February 2040 target | ₹787 |

| March 2040 target | ₹790 |

| April 2040 target | ₹795 |

| May 2040 target | ₹810 |

| June 2040 target | ₹814 |

| July 2040 target | ₹817 |

| August 2040 target | ₹819 |

| September 2040 target | ₹822 |

| October 2040 target | ₹837 |

| November 2040 target | ₹847 |

| December 2040 target | ₹854 |

- The estimated price of one IRB Infra Share Price Target will be around ₹750 at the start of 2040.

- If the market does well, the price could go up to ₹817 by the middle of the year.

- By the end of 2040, the share price might even reach ₹854.

IRB Infra Share Price Target 2050

| Month | Target |

| January 2050 target | ₹2251 |

| February 2050 target | ₹2264 |

| March 2050 target | ₹2267 |

| April 2050 target | ₹2269 |

| May 2050 target | ₹2274 |

| June 2050 target | ₹2294 |

| July 2050 target | ₹2313 |

| August 2050 target | ₹2323 |

| September 2050 target | ₹2334 |

| October 2050 target | ₹2347 |

| November 2050 target | ₹2357 |

| December 2050 target | ₹2385 |

- The estimated price of one IRB Infra Share Price Target will be around ₹2251 at the start of 2040.

- If the market does well, the price could go up to ₹2313 by the middle of the year.

- By the end of 2040, the share price might even reach ₹2385.

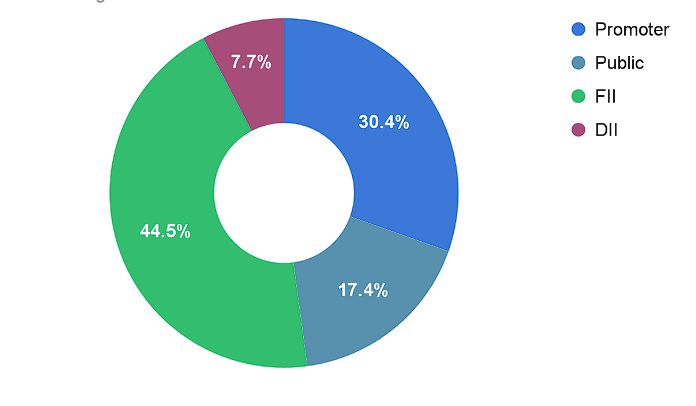

Shareholding

The company’s growth also depended upon the type of investors who invested in the share.

Promoter shareholding

- Those who invest in the public market expect to profit in the future.

Public shareholding

- Those who invest in the public market expect to profit in the future.

Foreign Institutional Investors or FII

- It refers to investors who are from other countries and who are investing in the Indian financial market.

Domestic Institutional Investors or DII

- Domestic institutional investors (DIIs) are Indian institutions that invest in India’s financial markets.

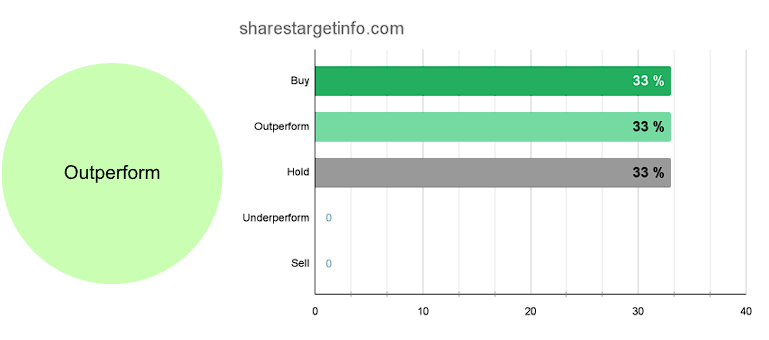

Analyst Rating

Analyst ratings say how an expert sees the stock, how much income the company generates, the project pipeline, share price performance, and other factors. Based on this, they recommend either buy, hold, or sell the stock.

- 33% of analysts recommend buying the stock.

- 33% of analysts recommend it will Outperform in the market.

- 33% of analysts recommend holding the stock.

Note: Don’t depend just on expert ratings. Research the stock yourself or seek advice from an expert.

FAQ

Conclusion

We hope (www.sharestargetinfo.com) gives you basic information about the IRB Infra Share Price Target. By doing research and taking advice from experts, We believe that the IRB Infra Share Price Target may become beneficial in the long run. The IRB Infra Share Price Target might also show an upward trend.

Also Read– Larsen & Toubro Share Price Target

Disclaimer:

We are not SEBI-registered advisors. We all know investing in the share market is risky. This website is for training and educational purposes only. Please Consult or take advice from certified experts before investing. We will not be responsible for any loss.

[…] Also Read – IRB Infra Share Price Target 2025, 2030, 2035, 2040, 2050 […]