This article will discuss a specific stock, ITC, and whether it’s a good investment. We will also discuss the company’s past performance, financial growth, shareholding patterns, and business policy. We use expert data and analysis to forecast the future share price of the stock and give clear information about the ITC Share Price Target. This article benefits both investors, whether you are a beginner or an experienced one.

Let’s have a look at the ITC Share Price Target from 2025 to 2050.

What does the ITC Company do?

ITC is a leading multi-national company that operates in various sectors across India, such as FMCG (Fast Moving Consuming Goods), luxury hotels, packaging, paperboards, agribusiness, and Information Technology. This means the company has diversified products and different revenue streams. The company was associated with tobacco back then but has also run a non-tobacco business over the years.

Overview of ITC Company

ITC, established in 1910, opened its IPO (Initial Public Offering) in 1974. Its objective is to make a balanced profit by delivering high-quality products to its customers, maintaining good relations with other businesses, and fulfilling its social responsibilities.

| Company Name | Indian Tobacco Company Limited (ITC Ltd) |

| Established In | 1910 |

| Market Capitalization | ₹6,39,218 Crore |

| Book Value | 59.58 |

| Face Value | 1 |

| P/B | 8.58 |

Financial Analysis of ITC Company

There are some criteria that you need to know before investing in any share such as company performance because it will give us all the necessary information for example overall profit, net sales, and total assets of the company. Apart from this, we should look into the company’s PE ratio, Return on Equity, Current Ratio, and more. In the upcoming paragraph, we will discuss these points in detail. The ratio is a very important factor because the ITC Share Price Target depends on it.

1. ITC Revenue

2. ITC Profit and Loss Analysis

| Data | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 | Mar 2024 |

| Net Profit | 15,306 | 13,161 | 15,242 | 19,191 | 20,458 |

| Net Cash Flow | +334.16 | -366.88 | -43.48 | +139.23 | +190.67 |

| Total Assets | 77,310 | 73,760 | 77,196 | 85,830 | 91,753 |

| Total Liabilities | 11,660 | 13,066 | 14,374 | 16,292 | 16,864 |

- Profit Growth: The company’s net profit has steadily increased over the past four years.

- Cash Flow Volatility: Net cash flow has fluctuated, with both positive and negative flows.

- Asset Expansion: Total assets have consistently grown, indicating investment and growth.

3. ITC Share Price Target Ratios

| Metrics | Value |

| PE Ratio | 31.36% |

| ROA (Return On Assets) | 21.3% |

| PB Ratio (Price-To-Book) | 8.58% |

| ROE (Return On Equity) | 27.46% |

PE Ratio (Price To Earning Ratio)

It shows how much money people are willing to pay for each rupee that a company earns.

- Formula – P/E Ratio = (Per share price / Per share earnings)

Return on Assets (ROA)

It means how efficiently a company is using its assets to generate profit.

- Formula – Current Ratio = Current Assets/Current Liabilities

PB Ratio (Price-to-Book Ratio)

It compares a company’s market value (share price) to its book value (net asset value).

- Formula – P/B Ratio = Market per Price Share/Per Book value share

ROE (Return On Equity)

It shows how well a company uses its owners’ money to make more profit.

- Formula – ROE = Company net income/shareholder’s equity.

Historical Data of ITC Share Price Target

ITC is registered under the Ministry of Corporate Affairs (MCA). It is a company that operates various businesses in India. ITC Share Price Target has fluctuated in the last few years. In the previous 6 months, share price growth was +94.60 (23.19%). Last 1 year, Share price growth was +55.00 (12.29%). And in the previous 5 years, when its IPO was open, its share price was ₹243. Today’s price is around ₹502.05, and its growth is +485.51 (2,866.06%) till now. This means the value of its share might increase in the future. If you buy shares now and hold them for a long time, you might make a profit.

ITC Share Price Target 2025

Factors may make a share’s value impact

ITC has diversified business model, including FMCG, luxury resorts and hotels, paper and packaging, and tobacco. They make revenue from these sectors, making them less dependable on a single industry. The FMCG sector had revenue growth of 9.6% YoY and profit growth of 29.4% YoY, making it an essential part of future growth. Through this diversification, the model has proven to be beneficial in reducing risk and ensuring the company’s steady growth.

| Months | Targets |

| January 2025 target | ₹595 |

| February 2025 target | ₹598 |

| March 2025 target | ₹601 |

| April 2025 target | ₹603 |

| May 2025 target | ₹608 |

| June 2025 target | ₹609 |

| July 2025 target | ₹610 |

| August 2025 target | ₹612 |

| September 2025 target | ₹617 |

| October 2025 target | ₹623 |

| November 2025 target | ₹634 |

| December 2025 target | ₹645 |

- The target for each month from August to December 2025 shows a consistent increase, indicating a steady growth trend.

- The target for each month is approximately ₹3 to ₹5 higher than the previous month, demonstrating a consistent monthly increment.

- The highest target is set for December 2025 at ₹635.

- The combined ITC Share Price Target for the five months from August to December 2025 is ₹3,108.

ITC Share Price Target 2030

Factors may make a share’s value impact

ITC has strong financial performance, such as consistent profits, solid cash flow, and a healthy dividend payout to its shareholders, making it appealing to investors looking for growth and profit. The company consistently reinvests its revenue in different sources for long-term growth, further enhancing the investment opportunity. ITC made a total profit of ₹20,000 in 2024, which is a good amount, and they have invested a portion of total revenue into other sectors to make more profit, such as Food and more.

| Month | Target |

| January 2030 target | ₹952 |

| February 2030 target | ₹957 |

| March 2030 target | ₹963 |

| April 2030 target | ₹965 |

| May 2030 target | ₹968 |

| June 2030 target | ₹970 |

| July 2030 target | ₹974 |

| August 2030 target | ₹976 |

| September 2030 target | ₹982 |

| October 2030 target | ₹989 |

| November 2030 target | ₹995 |

| December 2030 target | ₹1002 |

- Highest Monthly Target: December 2030 with ₹1002.

- Lowest Monthly Target: February 2030 with ₹952.

- Average Monthly Target: ₹968.2.

- Overall Trend: Monthly ITC Share Price Target generally increase throughout the year, with some fluctuations.

ITC Share Price Target 2035

Factors may make a share’s value impact

Financial experts think that shares of ITC are worth buying in the long term, and they expect the stock price to steadily increase in the future based on the sum-of-the-parts (SOTP) valuation. According to the report, the value of the ITC cigarette business is 20x EV/EBITDA for FY 2026. In other words, they believe it is a precious business because it’s generating more revenue than others, and they expect it to increase in the future, so it’s an excellent option to invest in in the long term.

| Month | Target |

| January 2035 target | ₹4,958 |

| February 2035 target | ₹4,859 |

| March 2035 target | ₹4,867 |

| April 2035 target | ₹4,876 |

| May 2035 target | ₹4,952 |

| June 2035 target | ₹4,925 |

| July 2035 target | ₹4,978 |

| August 2035 target | ₹4,989 |

| September 2035 target | ₹4,982 |

| October 2035 target | ₹4,987 |

| November 2035 target | ₹5,021 |

| December 2035 target | ₹5,078 |

- Highest Monthly Target: December 2035 with ₹5,078.

- Lowest Monthly Target: March 2035 with ₹4,867.

- Average Monthly Target: ₹4925.2.

- Overall Trend: Monthly ITC Share Price Target consistently increase throughout the year, with minimal fluctuations.

ITC Share Price Target 2040

Factors may make a share’s value impact

ITC has strategic plans to separate its hotels and luxury business into a different company. The objective of the decision was to address the over-efficiency of firms. This move is beneficial for the shareholders because it’s expected to upsurge the value of their investment. In addition, the hotel business’s demerger could benefit ITC and the new hotel company by helping them operate smoothly. ITC has approval from the stock exchanges.

| Month | Target |

| January 2040 target | ₹10,124 |

| February 2040 target | ₹10,254 |

| March 2040 target | ₹10,352 |

| April 2040 target | ₹10,425 |

| May 2040 target | ₹10,324 |

| June 2040 target | ₹10,427 |

| July 2040 target | ₹10,365 |

| August 2040 target | ₹10,424 |

| September 2040 target | ₹10,475 |

| October 2040 target | ₹10,487 |

| November 2040 target | ₹10,565 |

| December 2040 target | ₹10,678 |

- Highest Monthly Target: December 2040 with ₹10,678.

- Lowest Monthly Target: January 2040 with ₹10,124.

- Average Monthly Target: ₹10,427.

- Overall Trend: Monthly ITC Share Price Target steadily increase throughout the year, with a significant jump in December.

ITC Share Price Target 2050

Factors may make a share’s value impact

ITC is a global leader in sustainability and is firmly committed to protecting the environment from different methods. They have collected and managed more plastic waste than it makes. In addition, they have maintained reasonable recycling rates for solid waste, carbon, and more. ITC now has another plan to protect the environment named Sustainability 2.0. This agenda helps to reduce pollution and use less of natural resources. By investing in ITC, you are indirectly supporting the sustainability initiative. These factors make the ITC investable for the long term.

| Month | Target |

| January 2050 target | ₹15,241 |

| February 2050 target | ₹15,345 |

| March 2050 target | ₹15,425 |

| April 2050 target | ₹15,524 |

| May 2050 target | ₹15,645 |

| June 2050 target | ₹15,452 |

| July 2050 target | ₹15,565 |

| August 2050 target | ₹15,625 |

| September 2050 target | ₹15,647 |

| October 2050 target | ₹15,689 |

| November 2050 target | ₹15,701 |

| December 2050 target | ₹15,805 |

- Highest Monthly Target: December 2040 with ₹15,805.

- Lowest Monthly Target: January 2040 with ₹15.241.

- Average Monthly Target: ₹15,645.2.

- Overall Trend: Monthly ITC Share Price Target steadily increase throughout the year, with a significant jump in December.

Also Read – Cochin Shipyard Share Price Target 2024, 2025, 2027, 2030

Shareholding

The company’s growth also depended upon the type of investors who invested in the share.

Promoter shareholding

- Those who invest in the public market expect to profit in the future.

Public shareholding

- Those who invest in the public market expect to profit in the future.

Foreign Institutional Investors or FII

- It refers to investors who are from other countries and who are investing in the Indian financial market.

Domestic Institutional Investors or DII

- Domestic institutional investors (DIIs) are Indian institutions that invest in India’s financial markets.

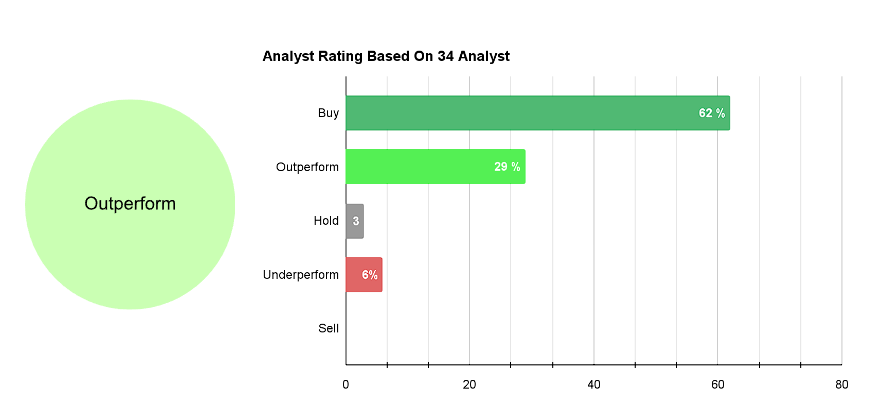

Analyst Rating

Analyst ratings say how an expert sees the stock, how much income the company generates, the project pipeline, share price performance, and other factors. Based on this, they recommend either buy, hold, or sell the stock.

- A majority of analysts (62%) recommend buying the share, indicating that it is undervalued and has good growth potential.

- (29%) predict the stock will outperform in the market.

- (3%) of analysts suggest holding the stock.

- (6%) of analysts believe the stock will underperform the market.

- Overall, the majority of analysts are bullish on the stock, with a strong recommendation to buy.

Note- Don’t depend entirely on analyst ratings. Research the stock yourself or ask for help from an expert. Analyst ratings are simply one part of the puzzle.

FAQ

Conclusion

We hope (www.sharestargetinfo.com) provides you with basic ITC Share Price Target information. By doing research and seeking advice from experts, the ITC Share Price Target will be beneficial in the long run. The share price might also show an upward trend in the future.

Disclaimer:

We are not SEBI-registered advisors. Investing in the share market is risky. This website is for training and educational purposes only. Please consult or get advice from certified experts before investing. We will not be responsible for any loss.

[…] Also Read – ITC Share Price Target 2025, 2030, 2035, 2040, 2050 […]